Navigating the Qualified Business Income DeductionDecember 26, 2018

The Tax Cuts and Jobs Act of 2017 brought a potentially significant tax break—some say the largest in decades—for small business owners in Section 199A. The IRS states:

“Eligible taxpayers may be entitled to a deduction of up to 20 percent of qualified business income (QBI) from a domestic business operated as a sole proprietorship or through a partnership, S corporation, trust or estate.”

Additionally:

“Eligible taxpayers may also be entitled to a deduction of up to 20 percent of their combined qualified real estate investment trust (REIT) dividends and qualified publicly traded partnership (PTP) income.”

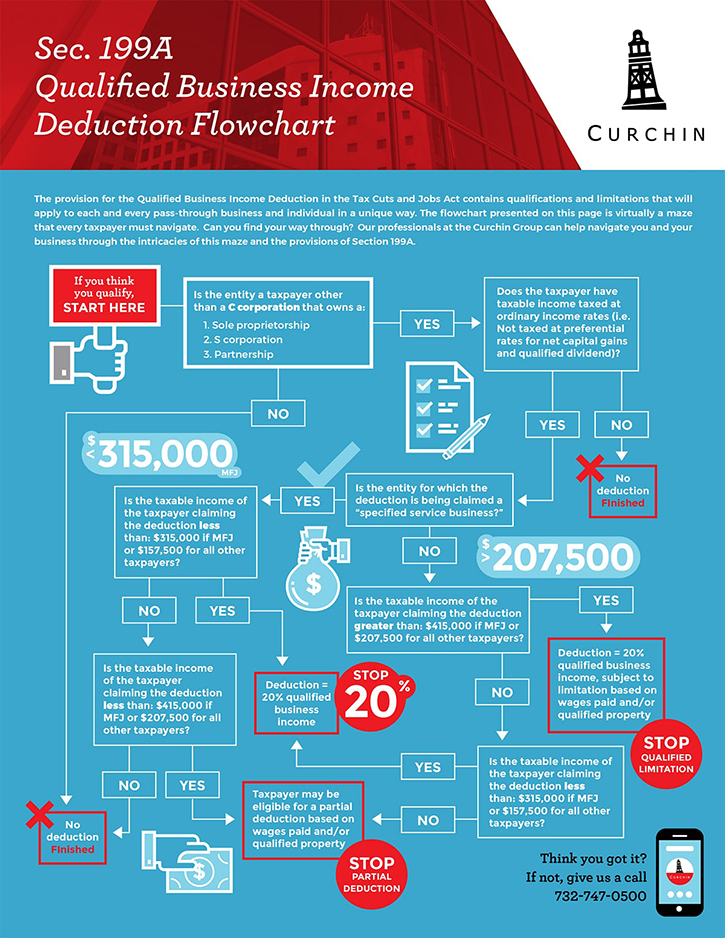

This new provision, referred to as the Qualified Business Income Deduction, comes with qualifications and limitations that can become very complex. Do you qualify, and, if so, for how much? Follow the flowchart below, and contact The Curchin Group for expert assistance with this and other tax matters.

Get In Touch

Please contact our team with any additional questions or feedback regarding this topic!